It would be wonderful if life went along smoothly and nothing ever went wrong. There were no accidents, no one made mistakes, and all plans played out just how they were intended to. However, as you will definitely know – and so will anyone else who’s ever lived – that is not how life is. Accidents do happen, people do make mistakes, and even the best pain plans can go awry. Because of this, insurance is crucial. Although it’s not mandatory (unless it’s car insurance), it’s still wise to have it; it’s far better to have insurance and never use it than to need it and not have it in place, after all. So if you want to be wholly protected from mistakes and accidents made by yourself or others, insurance is vital – here are the insurances everyone should have.

Table of Contents

Home Insurance

In some cases, if you have a mortgage, you’ll have to get home insurance simultaneously, although there’s nothing to stop you from canceling that insurance a few months later down the line once the insurance is set up. It’s not a good idea to do this; it’s far better to keep paying for your home insurance just in case something happens. No search indemnity insurance will keep you from having issues later.

Home insurance can cover buildings insurance that will pay for the cost of any major repairs that your property might need – it’s all about the building’s structure. It will also include contents insurance, which, as the name suggests, takes care of your home’s contents. If you were robbed, the contents insurance would help you, for example. You can get your homeowners insurance from Roger Welch Agency.

Car Insurance

As we’ve mentioned, car insurance is a legal requirement if you drive a car, and if you’re found to be driving without insurance, you will be fined, you may lose your license, and if someone was hurt or worse, you could certainly be imprisoned. It’s just not worth the risk.

Car insurance will protect you, your vehicle, and other road users should the worst happen. It will even help you if your car is stolen. And although sometimes car insurance can be expensive, it’s possible to find the most affordable car insurance if you take the time to look around. Make sure that whatever policy you choose will cover everything you need.

Life Insurance

No one wants to think about dying, but it will happen to each one of us, and if you still have a mortgage left to pay or a family to provide for, what would happen? If you have life insurance, you wouldn’t have to worry about it. The policy would take care of everything, and your family would be financially stable.

Health Insurance

If you have young children, health insurance is critical. Health insurance is important for the young and the old, and even the in-between ages. You never know when a major health issue appears.

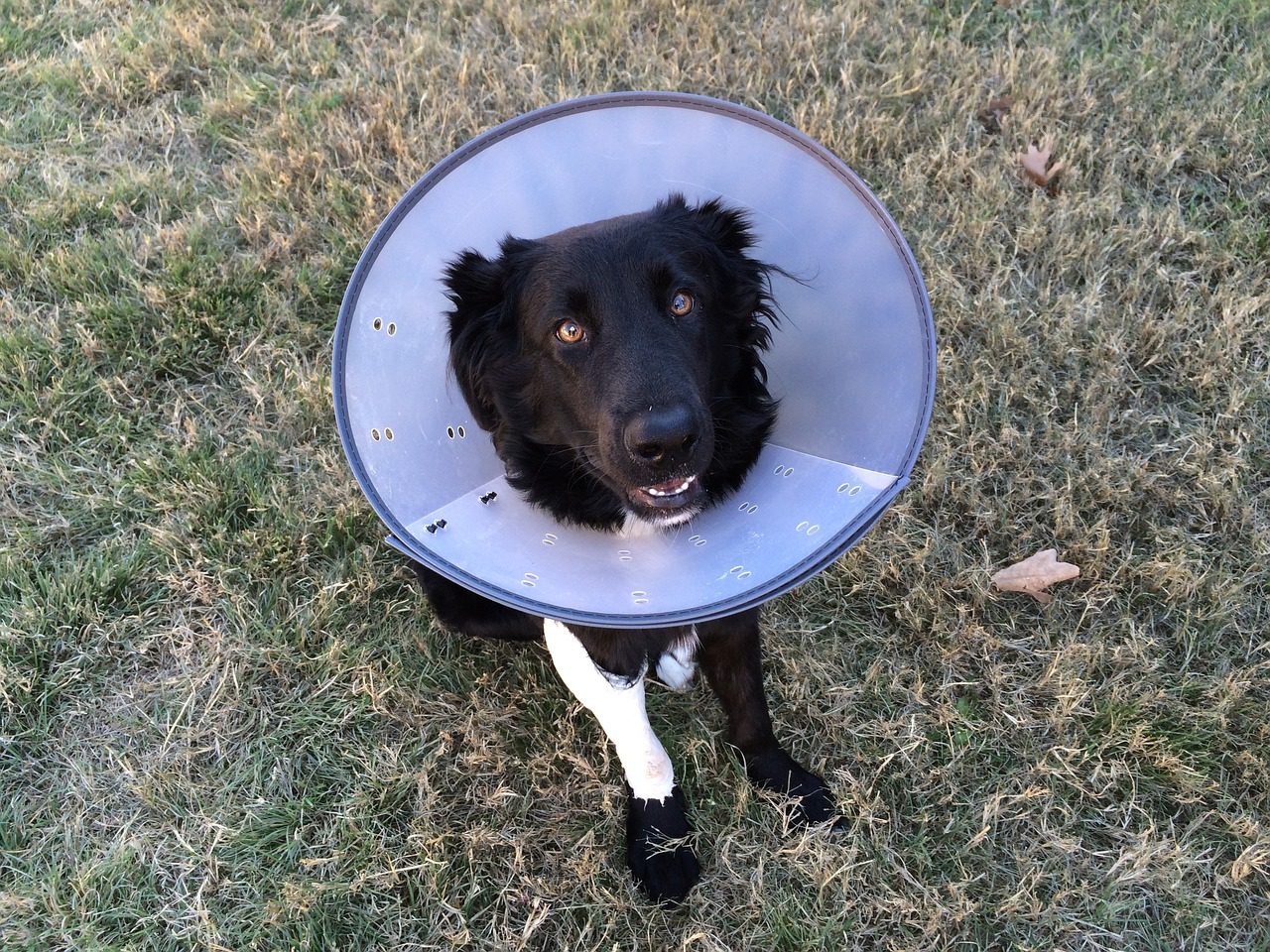

Pet Insurance

Pet insurance is another cost some pet owners don’t want to pay. They assume that their pet will be relatively healthy, and even a couple of trips to the vet for a virus or minor injury won’t cost any more than the insurance would; it might even cost less.

True. Some minor procedures and some medication won’t cost you a lot. However, some will cost a great deal, running into the thousands of dollars, sometimes more. Without insurance, you would have to bear the cost of this yourself, and if you couldn’t afford it, your pet may have to be removed from your home. Remember, a pet can develop a long-term illness at any time or suffer a serious accident. This will all need to be paid for.

Consider these types of insurance that everyone should have. You never know when something will happen, and you will be happy you had the insurance.

Featured Image by Allison Peterson from Pixabay