If you are a homeowner struggling to make your mortgage payments, you may be eligible for different relief programs. The GSE relief program is a government-sponsored entity that assists homeowners struggling to make their mortgage payments.

If you are interested in applying for such a program, it is essential to know if you are eligible. This blog post will provide instructions on checking your eligibility for the GSE mortgage relief program.

Table of Contents

What Are GSE Relief Program?

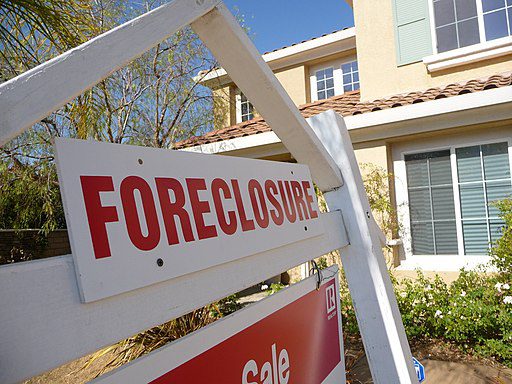

These programs are available through different government-sponsored entities, such as Fannie Mae, Freddie Mac, and the Federal Housing Administration (FHA). These programs offer assistance to homeowners struggling to make their mortgage payments. The aim of the program is to help homeowners avoid foreclosure and keep their homes. They may also provide other types of assistance, such as refinancing or modification of your mortgage loan.

Benefits of the GSE Mortgage Relief Program

The GSE relief program offers many benefits to homeowners. Some of these benefits include:

–Avoiding Foreclosure: One of the primary benefits of the GSE relief program is that it can help you avoid foreclosure. You may risk losing your home if you struggle to make your mortgage payments. The relief program can help you keep your home and avoid foreclosure.

–Lowering Monthly Payments: The GSE relief program also benefits from lowering your monthly mortgage payments. If you have problems making your monthly mortgage payments, this program may be able to help you. It can assist you in lowering your monthly costs and making them more manageable.

–Getting Other Types Of Assistance: Other types of help, such as refinancing or modifying your home debt, may be available through the GSE relief program. If you’re having issues or problems making your mortgage payments, this program may be able to assist you. It can help you prevent foreclosure by lowering your monthly costs and making them more reasonable.

What Are the Eligibility Requirements?

To be eligible for the program, homeowners must meet specific criteria.

First, they must be current on their mortgage payments. Homeowners who are delinquent on their mortgage payments or have already gone through foreclosure are not eligible for the program.

Second, homeowners must have a financial hardship that has made it challenging to make their mortgage payments. Examples of difficulties that would make a homeowner eligible for the program include job loss, unexpected medical expenses, or divorce.

Finally, homeowners must live in the home that is being foreclosed on. The GSE Mortgage Relief Program is not available to investors or landlords. If you think you meet the eligibility requirements for the GSE mortgage relief program, don’t hesitate to contact your mortgage servicer for more information.

Restrictions on the Relief Program

There are some restrictions on the GSE Mortgage Relief Program.

First, the program is not available to all homeowners. You must meet specific eligibility requirements to qualify for the program.

Second, the program may only be available for a limited time. The government has not announced how long the program will be available.

Third, the program may only be available to certain types of mortgages. The government has not announced which kinds of mortgages will be eligible for the program.

Your mortgage servicer is the best point of contact for questions about the GSE relief program or any other type of mortgage relief program. They will be able to tell you if you are eligible for the program and provide you with more information on how to apply.

Featured respres, CC BY 2.0 via Wikimedia Commons